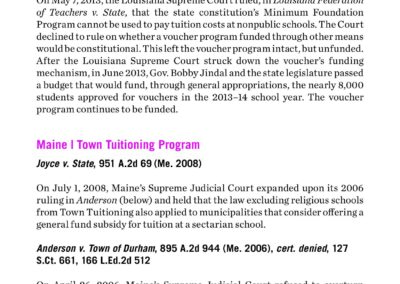

Federal Scholarship Tax Credit (FSTC)

Empowering Families With School Choice

The Federal Scholarship Tax Credit (FSTC), established through the Educational Choice for Children Act (ECCA), gives families the ability to choose the K–12 educational path that best fits their children. Funded through federal tax-credit scholarships, it provides tuition assistance and education-related support that help students succeed in private schools, homeschool settings, and other non-public learning environments.

2025 Legal Landscape PDF Download | EdChoice.org

Who Supports the Federal Scholarship Tax Credit

Support for the Federal Scholarship Tax Credit (FSTC) comes from a diverse and growing coalition of families, educators, organizations, and businesses who believe in expanding educational opportunity through school choice.

Parents and Families

Millions of parents across the country support the FSTC because it provides them with real options to choose the best education for their children – whether that means a faith based school, a STEM focused academy, or a personalized homeschool environment. Many families credit the FSTC with helping them afford a school that aligns with their values and meets their child’s unique needs.

Nonprofit Scholarship Organizations

Dozens of authorized 501(c)(3) scholarship organizations support the FSTC by managing application processes, distributing funds, and working directly with families. These nonprofits serve as the backbone of the program, ensuring that tax credit donations reach the students who need them most.

Educators and School Leaders

Private school administrators, homeschool associations, and faith based educators endorse the FSTC because it helps increase access, enrollment, and educational equity. The funding provides financial stability for schools while ensuring students from all backgrounds can participate.

Faith Based and Values Based Institutions

Many religious communities strongly support the FSTC. Catholic dioceses, Christian academies, Jewish day schools, and Islamic learning centers rely on FSTC scholarships to help families afford religious education without financial hardship.

Business and Philanthropic Leaders

Entrepreneurs, small businesses, and corporate donors support the FSTC because it provides a meaningful way to invest in future generations. With a generous federal tax credit, donors can make a difference in education while supporting causes that align with their values.

Education Policy Advocates

Think tanks and education reform groups such as EdChoice, the American Federation for Children, and the Heritage Foundation have praised the FSTC for promoting school choice, driving innovation, and empowering parents. These organizations often provide research, policy recommendations, and public support for continued program growth.

Community Leaders and Elected Officials

Local leaders, school board members, and lawmakers who champion educational freedom support the FSTC as a solution that benefits both families and communities. They view it as a tool that lifts up students and gives parents a greater voice in education.

Key Benefits of the Federal Scholarship Tax Credit

The Federal Scholarship Tax Credit (FSTC) delivers long term value to students, families, donors, and communities. Here are the most impactful benefits of the program:

Provides Real Educational Options

The FSTC helps families break free from school district limitations by opening access to private, religious, hybrid, and homeschool programs. Parents can choose what’s best for their child – not just what’s closest to their ZIP code.

Supports Low and Middle Income Families

Scholarships are designed to reduce the financial burden on working class families. The program prioritizes those who otherwise could not afford alternative education, helping to level the playing field.

Improves Student Outcomes

Research shows that access to school choice leads to higher graduation rates, better academic performance, and increased student satisfaction. Students are more likely to succeed when placed in an environment that fits their learning style.

Promotes Educational Equity

By offering scholarships across all regions – including urban, rural, and underserved areas – the FSTC expands opportunity regardless of background, race, or income level.

Encourages Innovation in Schools

When families have options, schools must compete by improving quality, updating curriculum, and offering specialized programs. The FSTC creates a healthier educational marketplace that puts students first.

Strengthens Faith Based and Mission Driven Education

Many parents choose religious or values based schools for moral, cultural, or spiritual reasons. FSTC scholarships make it possible for families to choose schools that align with their beliefs.

Incentivizes Charitable Giving

The FSTC offers generous federal tax credits to individuals and businesses that support education through qualified nonprofit scholarship organizations. This encourages ongoing investment in student success.

Drives Local Economic Growth

Increased enrollment in private and alternative schools creates demand for educators, support staff, transportation, extracurricular programs, and educational resources – all of which benefit local economies.

Gives Parents More Control

Parents are empowered to make meaningful decisions about their child’s future. The FSTC restores the role of the parent in guiding educational outcomes, rather than relying solely on state or district policies.

Reduces Pressure on Public Schools

As more students enroll in alternative programs through FSTC support, public schools can better allocate resources to students who remain. The result is a more balanced and manageable education system.

Promotes Diverse Educational Models

From Montessori and STEM academies to language immersion schools and specialized therapeutic programs, the FSTC allows families to choose the environment where their child will thrive.

Builds a Culture of Accountability

When families have choices, schools are more accountable to parents and students. The FSTC encourages performance, transparency, and responsiveness across the educational landscape.

What is the Federal Scholarship Tax Credit (FSTC)?

The FSTC is a federal tax credit program that helps fund K-12 scholarships through private donations. These scholarships support families who choose private, religious, homeschool, or other non-public education options.

Who is eligible to receive scholarships under the FSTC?

Scholarships are awarded to students based on income level, educational need, and eligibility guidelines set by participating nonprofit organizations. The program focuses on serving low- and middle-income families, students with special needs, and those in underserved areas.

What can FSTC scholarship funds be used for?

FSTC funds may be used for private school tuition, homeschooling materials, tutoring, special education services, education-related technology, and other approved academic expenses.

How much is the tax credit for donors?

Individuals can receive up to $5,000 per year in federal tax credits for qualifying donations. Businesses may claim up to $1 million annually. The credit directly reduces a taxpayer’s federal income tax liability.

Is there a cap on how much tax credit can be claimed nationally?

Yes. The FSTC includes a national annual cap on the total tax credits available. This cap helps ensure predictable funding levels and long-term program sustainability. Once the cap is reached in a given year, additional donations will not qualify for a credit until the next calendar year.

How do I donate to support FSTC scholarships?

Donations must be made to IRS-recognized nonprofit scholarship-granting organizations approved under the FSTC program. A list of participating organizations is available through the Department of Education or your local state education office.

Will this impact public school funding?

No. The FSTC is funded entirely by private donations, not by reallocating public education budgets. It adds new resources to the education system and does not reduce funding for public schools.

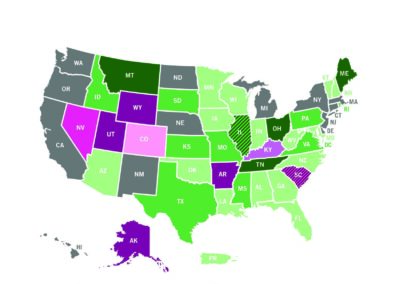

Is the FSTC available in every state?

Yes. The FSTC is a nationwide federal program. However, the availability of scholarships may vary depending on the presence of participating scholarship organizations in each state.

How can parents apply for an FSTC-funded scholarship?

Parents apply directly through participating nonprofit scholarship organizations. These organizations set application deadlines, eligibility criteria, and documentation requirements, and they manage award distribution.

What makes the FSTC different from other school choice programs?

Unlike voucher programs that rely on public funds, the FSTC operates through private donations incentivized by federal tax credits. It offers families additional choice without affecting public school budgets and promotes a privately supported, voluntary approach to education funding.

ECCA In The News

The form below will connect you with a qualified FSTC representative who can guide you through the process.

FSTC Tax Credit Form

"*" indicates required fields